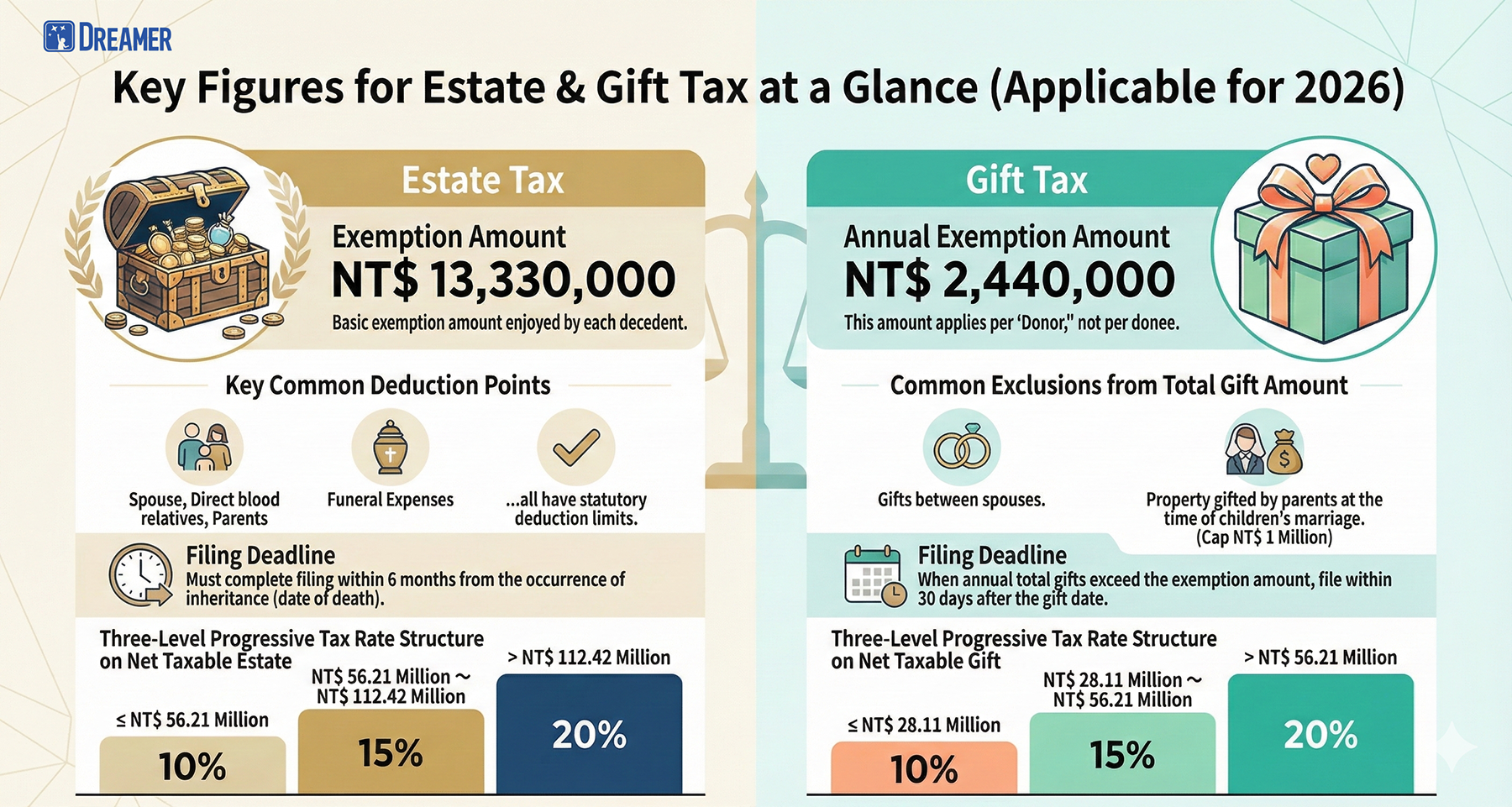

For 2026, the exemptions, deductions, and tax brackets for Estate and Gift Tax will generally follow the standards announced in the previous year.

✅ Therefore, the key focus in recent years is not on the specific amounts, but rather on "How specific scenarios are determined" and "How tax liability is allocated."

"Gifts to a Spouse" within 2 Years of Death are Still Taxed, but Liability Allocation is Clearer.

If the decedent gifted property (commonly: cash, stocks, or real estate transfers) to their spouse within 2 years prior to passing away, this gift is legally classified as "Deemed Estate" (擬制遺產) for Estate Tax purposes and, in principle, will still be included in the taxable estate.

The recent change lies in "Who bears the tax burden": To avoid the unfair situation where "someone who didn't receive the property has to pay tax on it," the tax authorities have clarified their operational direction. It typically works as follows:

✅ Our Advice: If your family plans to strictly execute "Asset Transfers Between Spouses" or "Large Adjustments Near Retirement/Old Age," you must plan for both the "2-Year Rule" and the "Tax Source (Cash Flow)" together.

Many people mistakenly believe: "Insurance proceeds are not estate, so they won't be taxed at all." In practice, you need to look at this from two different angles:

✅ Our Advice: Conduct a "Dual-Track Check" for your insurance portfolio to avoid assuming assets are isolated, only to find them taxable under a different tax system.

To ensure your planning is actionable and to reduce future procedural costs for your family, we typically start with an "Inheritance & Transfer Health Check":

A. Asset Inventory (Confirm direction in just 10–15 minutes)

Goals We Aim to Achieve:

B. Proposal of Feasible Solutions (Based on your preferences and compliance requirements)

(Disclaimer: The information above is a general summary and does not constitute individual legal or tax advice. Actual application is subject to individual case facts, documentation, and the determination of the competent authorities.)

%203.png)

Rethinking wealth succession in the age of deepfakes

.png)

What a celebrity’s sudden passing reveals about non-bloodline succession risks

.png)

Why business risk should never be shared by family assets.

Cross-Border Real Estate Allocation – Trust Case Studies

The information provided on this website is for general information purposes only and does not constitute an offer, and the Website and all information provided to you via the website are provided “as is” and “as available”, the content described herein is subject to change without notice from Dreamer Group Limited and/or any of its members, affiliated entities (Dreamer Group Limited and all its members and affiliated entities collectively referred to as the “Dreamer Group” herein after). We will strive to ensure the integrity and accuracy of the website's functionality and content, while, to the maximum extent permitted by applicable law, we disclaim all express, implied, and statutory warranties with respect to the same, including without limitation any implied warranties of merchantability, satisfactory quality, fitness for a particular purpose, accuracy, completeness, non-infringement, non-interference, error-free service, and uninterrupted service.

By making available the websites, Dreamer Group is not making an offer of any financial, tax, accounting, legal or other professional services or goods, and none of the information presented on the websites should be construed as finance, tax, accounting, legal or any other professional advice or service. You should always seek the advice of a suitably qualified professional before taking or refraining from taking any action. Dreamer Group will not be liable in any way to any person for any action taken or omitted to be taken as a result of the use of any content posted by us, which results in, causes or gives rise to any loss.

The laws of some jurisdictions may impose restrictions on the distribution of materials described on this Site. This Site is not directed to persons in jurisdictions where such restrictions apply. If you belong to such areas or you are in such areas, please exit this website immediately and you will be responsible for any losses, controversies, disputes and other negative consequences arising from your continued browsing.

All information, text and images on this website are copyrighted or registered by DREAMER GROUP.

We urge all persons contacting Dreamer Group to check the website and service number carefully and to remain vigilant to avoid being deceived or misled by unscrupulous persons.

This disclaimer is written in Chinese and the English version is provided for information purposes only.